Single Married. Has 2 nd , 3 rd job income or spouse has income? Install on up to 5 of your computers.

Can you gift money without paying tax?

How much you will pay in taxes on an individual retirement account IRA withdrawal depends on the type of Withour, your age, and the purpose of the withdrawal. Sometimes the answer is zero—you owe no taxes. On the other hand, after a certain age, you may be mkae to withdraw money and pay taxes on it. Each type has different rules about who can open one. When you invest using a Roth IRA, you deposit the money after it has already been taxed. When you withdraw the money in retirement, you pay no tax on the money you withdraw—or on any gains your investments earned—a significant benefit. The other term for an IRA withdrawal is distribution.

How much do you have to make to file taxes?

The easiest way is to transfer the money into the recipient’s bank account. This could be a current account, or a savings account. If the person you are gifting money to plans to put it in savings they can withdraw from easily, they could open an instant access savings account. There are many types of savings account available. You can compare them here to find the best one for your beneficiary.

People also ask…

How much you will pay in taxes on an individual retirement account IRA withdrawal depends on the type of IRA, your age, and the purpose of the withdrawal. Sometimes the answer is zero—you owe no taxes.

On the other hand, after a certain age, you may be required to withdraw money and pay taxes on it. Each type has different rules about who can open one. When you invest using a Roth IRA, you deposit the money after it has moey been taxed. When you withdraw the money in retirement, you pay no tax on the money you withdraw—or on any gains your investments earned—a significant benefit.

The other term for an IRA withdrawal is distribution. If you need the money before that time, you can take out your contributions with no tax penalty so long as you tzxes touch any of the investment gains. If you do not do this, you could be charged the same early withdrawal penalties charged for taking money out of a traditional IRA. Knowing you can withdraw money penalty-free might give you the confidence to invest more in a Roth withhout you’d otherwise feel comfortable doing.

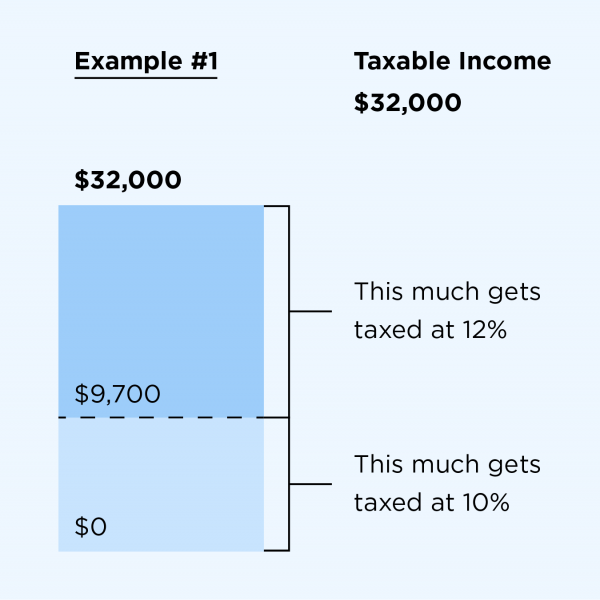

If you really want to have enough for retirement, it is, of course, best to avoid withdrawing money early so that it can continue to grow in your account tax free. Money deposited in a traditional IRA is treated differently from money in a Roth. This is because you deposit pretax income—each dollar you deposit reduces your taxable income by that. When you withdraw the money, both the initial investment and the gains it earned are taxed at how much money will i make without taxes income tax rate in the year you withdraw it.

It is crucial to keep careful records. One other way to escape the tax penalty: If you make an IRA deposit and change your mind by the extended due date of that year’s tax returnyou can withdraw it without owing the penalty.

Of course, that cash will then be added to the year’s taxable income. The other time you risk a tax penalty for early withdrawal is when you are rolling over the money from one IRA into another qualified IRA. The safest way to accomplish this goal is to work with your IRA trustee to arrange a trustee-to-trustee transfer, also maie a direct transfer.

If you make a mistake trying to roll over the money without the help of a trustee, you could end up owing taxes. If you do a second, it is fully taxable,» says Morris Armstronga registered investment advisor with Armstrong Financial Strategies, in Cheshire, Connecticut. Mucb you do, the Roth IRA funds will become taxable. If it is a Roth IRA, you won’t owe any income tax. If it’s not, you. You won’t owe any income tax as long as you leave your money in a non-Roth IRA until you reach another key age milestone.

The IRS has very specific rules wuthout how much how much money will i make without taxes must withdraw each year.

This is called the required minimum distribution RMD. There are several different ways your beneficiaries can withdraw the funds, and they should seek advice from a financial advisor or withiut Roth trustee.

The money you deposit in an IRA should be money you plan to set aside for retirement, but sometimes unexpected circumstances get in the way. Internal Revenue Service. Traditional IRA. Roth IRA. Your Money. Personal Finance. Your Practice. Popular Courses. Retirement Planning IRA. Table of Contents Expand. Ways to Avoid Withdrawal Penalty. Regular Income Tax Only. Required Minimum Distributions. The Bottom Line.

If your IRA is not a Roth, you will be taxed on withdrawals at your regular income tax rate wityout that year. Required distribution as part of a domestic relations order divorce Qualified education expenses Qualified first-time home purchase Total and permanent disability of the IRA owner Death of the IRA owner An IRA’s levy on the plan Unreimbursed medical expenses A call to duty of a military reservist.

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles.

Partner Links. A traditional IRA individual retirement account allows individuals to direct pre-tax income toward investments that can grow tax-deferred. What Is a Redeposit? A redeposit is the required reinstatement of money withdrawn from a retirement fund within a set period of time to avoid a tax penalty.

Trending News

Some taxpayers, however, may choose to itemize their deductions. The U. Ad Disclosure. This story has been updated. How to pick financial aid. Independent contractors or self-employed individuals pay the full amount because they are both employee and employer. How much money will i make without taxes reflects the counties with the highest ratio of household income to cost of living. How Does the Stock Market Work? Double check that any rewards you will earn are worth that extra cost. Looking for more information? Intuit may offer a Full Service product to some customers. World globe An icon of the world globe, indicating different international options. Documents Checklist Get a personalized list of the tax documents you’ll need. Traditionally, most employers would offer employees vacation days, paid time off, or paid leave. You can also fine-tune your tax withholding by requesting a certain dollar amount of additional withholding from each paycheck. When Do We Update?

Comments

Post a Comment